How Do Convertible Note Work . What is a convertible note? a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. In short, a convertible note is originally structured as a debt investment but has a. how convertible notes work. this post covers how convertible notes work, their advantages, and potential pitfalls. A hybrid of debt and equity.

from eqvista.com

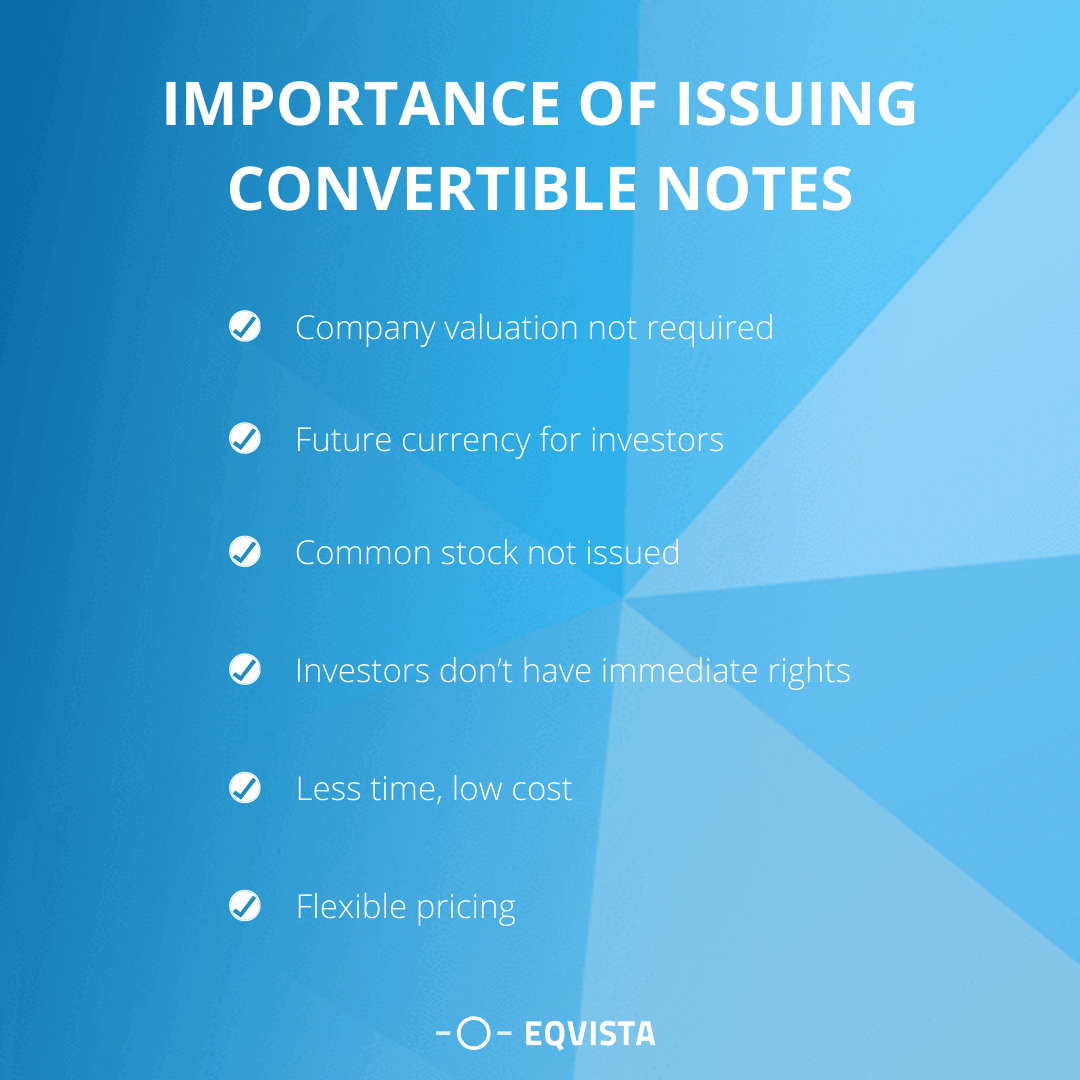

this post covers how convertible notes work, their advantages, and potential pitfalls. how convertible notes work. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. What is a convertible note? A hybrid of debt and equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. In short, a convertible note is originally structured as a debt investment but has a.

Convertible Note Term Sheet Eqvista

How Do Convertible Note Work In short, a convertible note is originally structured as a debt investment but has a. this post covers how convertible notes work, their advantages, and potential pitfalls. In short, a convertible note is originally structured as a debt investment but has a. What is a convertible note? When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. A hybrid of debt and equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. how convertible notes work.

From www.youtube.com

Convertible Note Terms How Convertible Notes Work YouTube How Do Convertible Note Work how convertible notes work. What is a convertible note? a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. A hybrid of debt and equity. In short,. How Do Convertible Note Work.

From westchesterangels.com

How Do Convertible Note Caps Work? Westchester Angels How Do Convertible Note Work convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. In short, a convertible note is originally structured as a debt investment but has a. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. What is a convertible note? When a startup issues a convertible. How Do Convertible Note Work.

From koreconx.com

How Does A Convertible Note Work? Kore AllinOne Platform How Do Convertible Note Work convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. how convertible notes work. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt. How Do Convertible Note Work.

From www.equidam.com

How Convertible Notes Work Equidam How Do Convertible Note Work A hybrid of debt and equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. how convertible notes work. a convertible note. How Do Convertible Note Work.

From info.raisegreen.com

How Does A Convertible Note Work? How Do Convertible Note Work this post covers how convertible notes work, their advantages, and potential pitfalls. A hybrid of debt and equity. What is a convertible note? a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. how convertible notes work. In short, a convertible note is. How Do Convertible Note Work.

From www.planprojections.com

Convertible Loan Notes Plan Projections How Do Convertible Note Work how convertible notes work. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. In short, a convertible note is originally structured as a debt investment but has a. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. A hybrid of. How Do Convertible Note Work.

From unrubble.com

What Are Convertible Notes and How Do They Work? Unrubble How Do Convertible Note Work When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. how convertible notes work. In short, a convertible note is originally structured as a debt investment but has a. What is a convertible note? a convertible note (otherwise called convertible debt) is a loan from investors that converts. How Do Convertible Note Work.

From startupsavant.com

Convertible Notes 101 What Is a Convertible Note? TRUiC How Do Convertible Note Work how convertible notes work. this post covers how convertible notes work, their advantages, and potential pitfalls. In short, a convertible note is originally structured as a debt investment but has a. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. a convertible note (otherwise called convertible debt) is a. How Do Convertible Note Work.

From www.tffn.net

Understanding Convertible Notes A Comprehensive Guide for How Do Convertible Note Work a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. this post covers how convertible notes work, their advantages, and potential pitfalls. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. how convertible notes work.. How Do Convertible Note Work.

From eqvista.com

4 Steps in Making a Convertible Note Agreement Eqvista How Do Convertible Note Work When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. In short, a convertible note is originally structured as a debt investment but has a. this post covers how convertible notes work, their advantages, and potential pitfalls. convertible notes are bonds issued by corporations that are convertible to. How Do Convertible Note Work.

From dxoptmaxc.blob.core.windows.net

What Is A Convertible Note Cap at Rodolfo Jones blog How Do Convertible Note Work What is a convertible note? In short, a convertible note is originally structured as a debt investment but has a. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. how convertible notes work. convertible notes are bonds issued by corporations that are convertible to company stock, depending. How Do Convertible Note Work.

From bizzcounsel.com

How Do Convertible Notes Work? How Do Convertible Note Work What is a convertible note? In short, a convertible note is originally structured as a debt investment but has a. this post covers how convertible notes work, their advantages, and potential pitfalls. A hybrid of debt and equity. how convertible notes work. a convertible note (otherwise called convertible debt) is a loan from investors that converts into. How Do Convertible Note Work.

From www.davidkircos.com

How Convertible Notes Convert, Template David Kircos How Do Convertible Note Work this post covers how convertible notes work, their advantages, and potential pitfalls. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. A hybrid of debt and equity. In short, a convertible note is originally structured as a debt investment but has a. . How Do Convertible Note Work.

From sarseh.com

Convertible Loan Note Template How Do Convertible Note Work a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. A. How Do Convertible Note Work.

From www.cakeequity.com

Convertible Notes The Complete Guide for Startups How Do Convertible Note Work how convertible notes work. What is a convertible note? a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is. How Do Convertible Note Work.

From waveup.com

What is a convertible note + Examples Waveup Blog How Do Convertible Note Work convertible notes are bonds issued by corporations that are convertible to company stock, depending on the. A hybrid of debt and equity. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which outlines the. What is a convertible note? a convertible note (also goes by convertible loan, convertible bond, or. How Do Convertible Note Work.

From startuptalky.com

What is Convertible Note and How To Raise Capital With it? How Do Convertible Note Work a convertible note (otherwise called convertible debt) is a loan from investors that converts into equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. When a startup issues a convertible note, the investor provides funding in exchange for a promissory note, which. How Do Convertible Note Work.

From www.pandadoc.com

Convertible Note What It Is & How Does It Work (Get Free Template) How Do Convertible Note Work What is a convertible note? A hybrid of debt and equity. a convertible note (also goes by convertible loan, convertible bond, or convertible promissory note) is a hybrid form of debt and investment that, under. this post covers how convertible notes work, their advantages, and potential pitfalls. In short, a convertible note is originally structured as a debt. How Do Convertible Note Work.